GST Invoice Format

How GST Bill in India has transformed the nation’s tax system?

The much awaited suspense on GST is out and the traders are gradually becoming familiar to it with the pace of time. Just to remind you, the Goods and Services Tax or GST is a ‘one nation one tax’ reform that further curtailed down thenumber of taxes imposed by central and the state governments in India. While many are now aware of this GST tax and practicing it in their professional lives, several traders are still perplexed and raring to learn the rules of the game. They feel themselves to be quite alien to their role with respect to GST and even don’t know whether they should file GST returns or not.

If you are also among the lot, there is nothing to worry about, as the government of India is providing detailed information on the whereabouts of GST, such as GST registration number, GST bill format, GST billing, etc. through one of its portals https://www.gst.gov.in, which is exclusively dedicated to GST. In addition, to know more about GST billing or any other of it aspect, we are always there to help you out. Proceeding with this discussion, here is a detailed information on GST billing including the GST invoice, issues related to GST bill, types of other invoices, how to create GST invoice and so on.</p>

Types of Invoices under GST

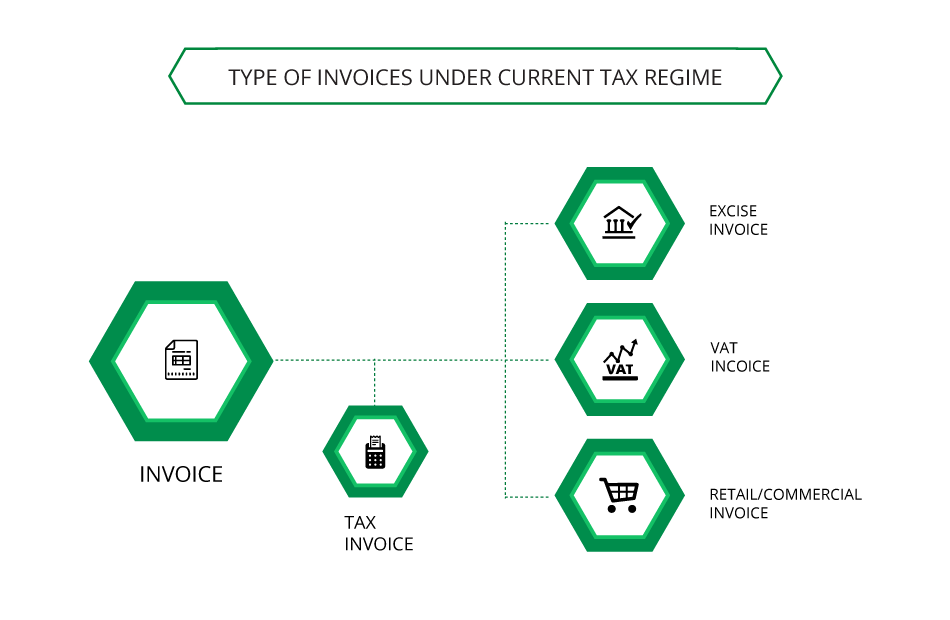

Prior to GST, the tax regime in India consisted of a multiple invoices such as Tax invoice, Excise invoice, VAT invoice and Retail/commercial Invoice, as shown in the image below. However, after July 2017, with the introduction of GST, the nation’s timeline has been divided into pre GST era and post GST era. The latter GST era is indeed better and is expected to pay rich GST dividends in the long run.

The GST invoice regime eases out this cumbersome invoicing system exceptionally. The issuance of GST invoice becomes necessary as soon as a GST registered tax payer supplies some services or goods.

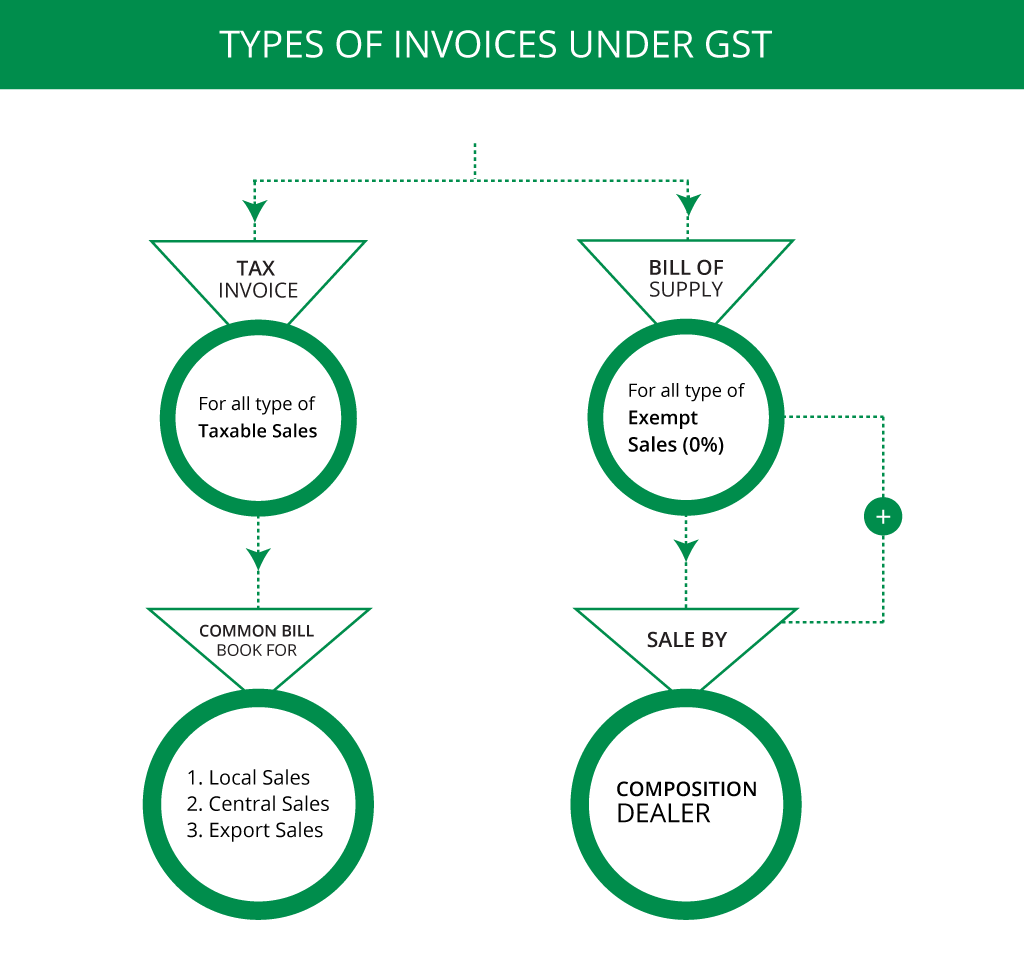

To be precise, two types of documents are issued under The GST invoice rule(s), 2016 – GST Tax invoice and Bill of Supply

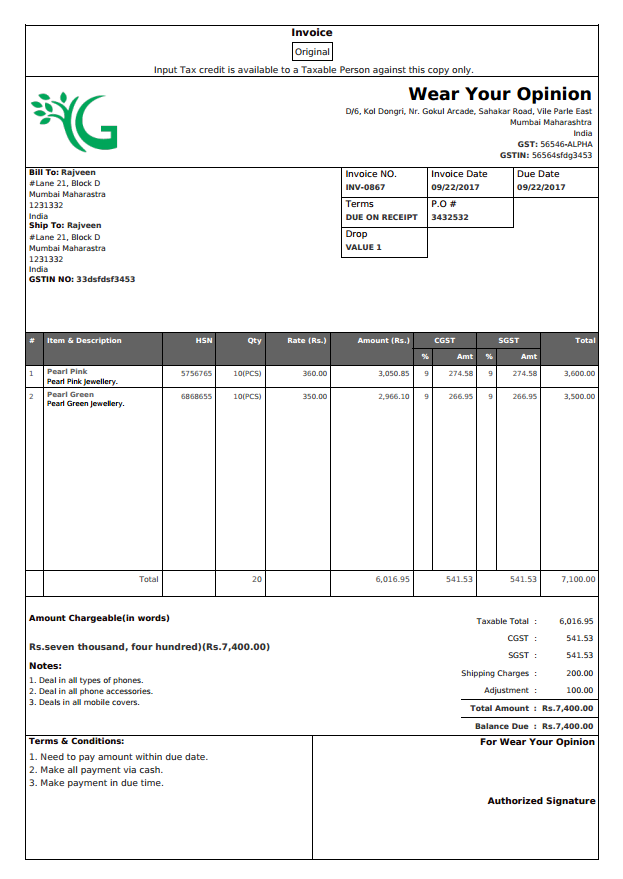

GST Invoice or Tax invoice

GST invoice or a GST bill that comprises the details of provided services or goods sent, together with the due payment amount. If your business is registered under GST, you would require providing GST-compliant invoices to the clients whether you selling goods or services. Likewise, you are also entitled to get GST compliant purchase invoices from your GST vendors. To cut it short, a GST tax invoice is issued when a taxable person supplies any product(s) or service(s). If you are a pro in excel, it will be even easier to create such GST invoices.

Contents of GST Tax invoice

Powered by iZAP Services Pvt Ltd.

The GST Tax invoice format includes:

- Name, Address & GSTIN of supplier

- Serial Number

- Date of issue, which relates to the concept of Time of Supply)

- Name, Address & GSTIN (if registered) of recipient

- HSN/SAC code (as per eligibility on turnover basis)

- Item Description, i.e. Quantity, Unit (m/kg, etc), Taxable Value

- Rate & Amount of Tax – CGST, SGST, IGST

- Place of Supply along with Address of Delivery (if different from POS)

- Information on whether GST is payable on reverse charge basis

- Signature or Digital Signature on the GST invoice

In addition, if the recipient does not have GST registration number and the GST tax invoice value exceeds 50,000 INR, then all such GST invoices should contain the following:

- Recipient’s name and address

- Delivery address

- state name and state code

You can also personalize your GST invoice by adding your company’s logo.

Minimum amount to raise GST invoice in India

If the value of goods or services is less than 200 INR, the supplier needs not issue any GST bill, if the recipient is unregistered and does not want GST invoice. However, if the recipient demands, the GST invoice needs to be issued. It is however wise to preparea consolidated GST tax invoice via excel in the specified format every day for all such types of supplies that were made without issuing any GST tax invoice.

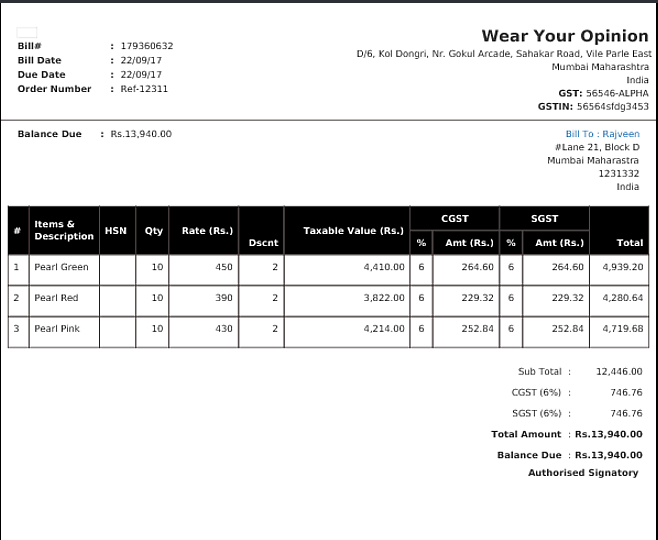

Bill of Supply

The GST invoices are issued to get the tax from the purchase on the behalf of the government. However, what if the recipient or thepurchaser is not registered under GST or of the supplier has been restricted to charge tax? In any such instances, the issuance of normal GST tax bill cannot take place. Hence, in the place of GST tax, the invoice format used is that of ‘Bill of Supply’.

This GST document becomes a hot property in the following occurrences: At the time of supplying Exempted/Nil-rated, Non-taxable/Non-GST services or goods.

- At the time when supplier is paying under composition scheme.

Notably there will be Same Series bill book format for Goods and Services, as well as for taxable local and central sales. The need for a separate bill book format or the ‘Bill of Supply’ would occur in case of exempted goods.

The format of the GST bill of supply document will include the following contents:

- Name, Address & GSTIN of supplier

- Consecutive Serial Number

- Date of issue

- Name, Address and GSTIN of recipient (if registered)

- HSN/SAC code

- Description of Goods, Quantity, & Value

- Handwritten or Digital Signature on the GST invoice

Same as in the case of GST tax invoice, the minimum amount to issue a bill of supply is 200 INR, unless the purchaser asks for the bill. Still, it is better to prepare a combined bill of supply for all such transactions on daily basis in the specified format, for which the bill of supply has not been issued.

Understanding invoicing under GST

Under GST, you can call a particular transaction as ‘Supply’, which refers to the exchange, disposal, transfer or license of any service or goods. Here, the term ‘Supply’ may also indicate leasing, renting or bartering one or more services or goods, subject to the condition. With the occurrence of any such transaction, the generation of a tax bill or invoice takes place within a certain time period. Hence, this makes every GST taxpayer, liable to issue GST invoice in the stipulated format for the supply of services or goods in a prescribed time as mentioned right here:

a) Conditions that necessitate raising GST invoice at the supply of goods:

- When actual movement of goods occurs, the issue of GST tax invoice takes place prior to or during the removal of goods.

- Prior to successive issuance of goods

- During the goods’ receipt when GST applies on it on the basis of a reverse charge

- Six months from the selling of goods on approval bases or before or during the removal of goods

In such cases of goods supply, the issuance of GST bill takes place in TRIPLICATE –

- The recipient gets original GST invoice.

- The transporter gets the duplicate GST invoice.

- The supplier gets the third GST invoice.

b) Conditions that necessitate raising GST bill at the supply of services

- Right within one month from the actual supply of services.

- 30 days from the due date, where due date can be estimated in the case of continuous supply of services.

- 30 days from actual payment date, where due date cannot be estimated in case of continuous supply of services.

- During termination, in case of termination of supply prior to the ending of contract.

In such cases of services supply, the issuance of GST bill takes place in DUPLICATE –

- Original GST invoice for the recipient.

- Duplicate GST invoice for the supplier. For banks or other financial establishments, the due date of issue of GST invoice in all these cases of supply of services has been relaxed from 30 days to 45 days.

Other types of GST invoices

Apart from the usual GST billing, there are some other invoices as well:

Aggregate invoice: Suppose an unregistered buyer ends up getting multiple number of invoices amounting to less than 200 INR in all. In any such case, the seller has the choice to issue a bulk or aggregate GST invoices in the stipulated format everyday.

Debit and Credit note: Issuance of debit note by the seller becomes necessary in cases where the amount that the buyer has to pay to the seller increases:

- GST Tax invoice accompanies lower taxable value as compared to the amount that needed to be charged actually.

- GST Tax invoice accompanies a lower tax value as compared to the amount that needed to be charged actually.

A seller issues a credit note in instances where the invoice value decreases:

- GST Tax invoice accompanies higher taxable value as compared to the amount that needed to be charged actually.

- GST Tax invoice accompanies a higher tax value as compared to the amount that needed to be charged actually.

- The buyer refunds the goods to the seller

- Services become deficient.

GST invoice - Special cases

Besides using GST invoice, there are some specific formats where GST invoicing formalities need to be dealt with accordingly:

Export: In case the goods or services are being exported from India, the GST invoice shall clearly mention “supply for export under bond or letter of undertaking without payment of integrated tax” or “Supply for export on payment of integrated tax”. In addition, the GST invoice should also consist of the name and address of the recipient, delivery address and the destination country of the goods or services.

Reverse Charge: Under reverse charge system, the recipient of the supply needs to pay GST tax. This condition necessitates when the registered GST recipient purchases the services or goods from an unregistered supplier. Consequently, the GST registered recipient must issue an invoice on the date of receiving the goods or services. The GST registered recipient also needs to mention on the invoice that he is paying tax on reverse charge. The person should retain this copy of GST invoice that will come handy in GST return filling purpose.

With GST invoicing format becoming mandatory for all the buyers and suppliers of goods and services in India, only awareness on GST could make them alert and kicking. Hence, it is good to gain relevant knowledge of this most recent revelation on the Indian soil. At GInvoicing, we are always there to assist you in your GST related endeavors. Feel free to contact us any time, we will be more than happy to respond to all your GST related queries.