GST Login Process– Your First Step toward Filing GST Return

GST Login – Your First Step toward Filing GST Return

GST has been a revolution in the tax system in India as it subsumes all the indirect taxes to leave the taxpayers with only a single indirect tax. Depending on the type of goods and services, this indirect tax has been further categorized into 5%, 12%, 18% and 28% tax slab, respectively. However, prior to paying taxes under GST, you need to register with the GST portal of the Government of India. Once you create an account with the GST site, you can login with your credentials and proceed with your GST tax paying regime thereafter.

The GST portal

Designed and development by GSTN or the GST Network, the GST portal, https://www.gst.gov.in furnishes complete details about the Goods and Services Tax in India. It helps the users with following facilities:

Services - These include:

- GST registration: New Registration, Application for Filing Clarifications, and Track Application Status.

- Payments: Create Challan and Track Payment Status.

- User Service: Holiday list and Search Office Address.

Notifications & Circulars: Notifications, Circulars, Amendments and Press Release.

Acts & Rules: Consist Acts and Rules related to GST.

Download Tools: The facility to download offline tools regarding GST returns. These include Returns Offline Tool and Tran-1 5(b) CSV template

Search Tax Payer: This is a welcome facility by the GST portal which helps one to search the tax payer through different ways. These include the option to Search by GSTIN/UIN, Search Migrated Taxpayer and Search Composition Taxpayer.

You can browse through the GST official website to find all the afore-mentioned information without logging into your account. However, to file returns and proceed with related obligations, GST login is a must, which will require you to mention your Username and Password provided at the time of GST registration. Once you sign in to your GST portal account successfully, you can carry out different tasks related to GST registration, GST return uploads, GST invoices upload and payment of GST taxes.

Registering with GST

Before you go on to sign in with your GST account, you need to register with it on the GST portal. However, if haven’t registered till now, then here is how you can do so.

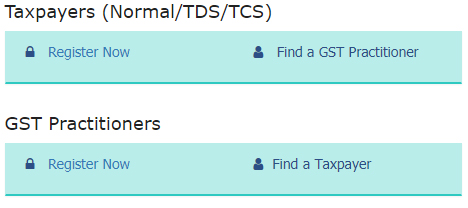

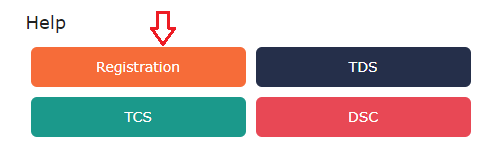

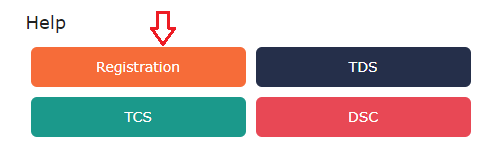

Open https://www.gst.gov.in and click Register Now, depending on whether you are a Normal Taxpayer or a GST practitioner. For more help on GST registration, you can click Registration in the help panel.

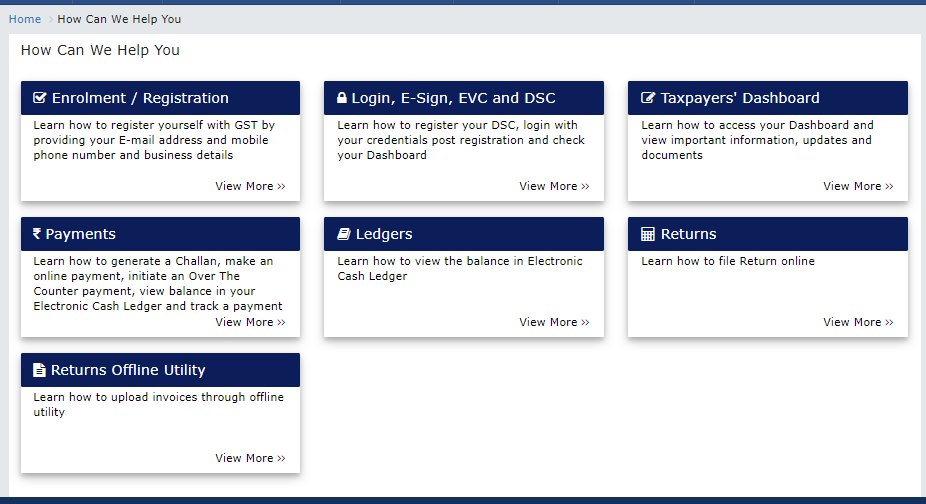

This will take you to How Can We Help You page to guide you further on GST regime.

Here, it is important to note that all the existing taxpayers registered under GST in India will get provision registration to start with. They would require submitting additional requisite documents in the 6 months’ time.

GST Portal Login

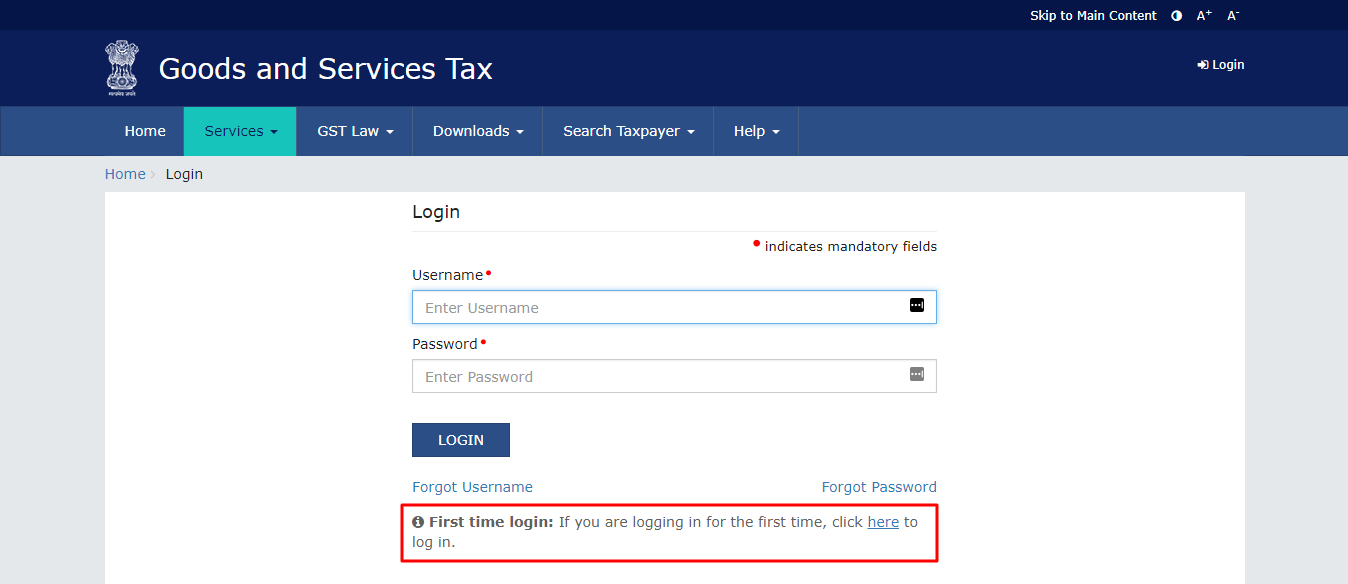

After registering with GST portal, you can sign in to your GST account anytime to carry out the necessary tasks. Here is the step-by-step procedure in the screenshots given below.

GST Login for New Tax Payers

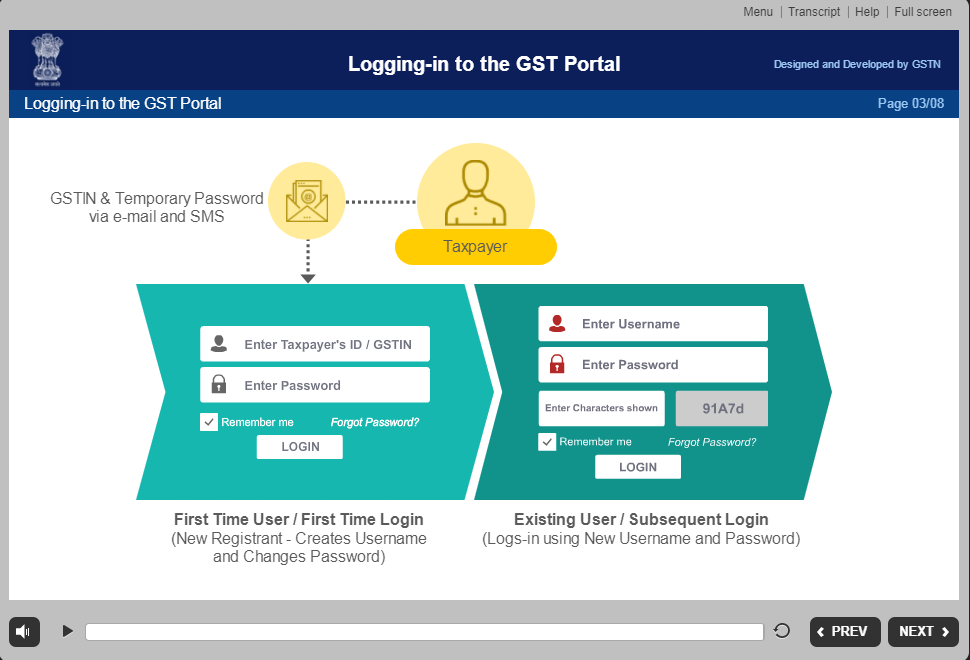

If you are a new GST taxpayer, then you need to sign in into GST Portal with the provided GSTIN and Password. Here are the necessary steps:

- Browse through https://www.gst.gov.in/.

- Click Login link on the top right of the home page of GST website.

- Look for the message “First time login: If you are logging in for the first time, click here to login” on the page and click here link.

- The resulting New User Login page will ask you to provide Provisional ID / GSTIN/ UIN, followed by your Password. ![new user login]/images/new-user.png)

- Click LOGIN.

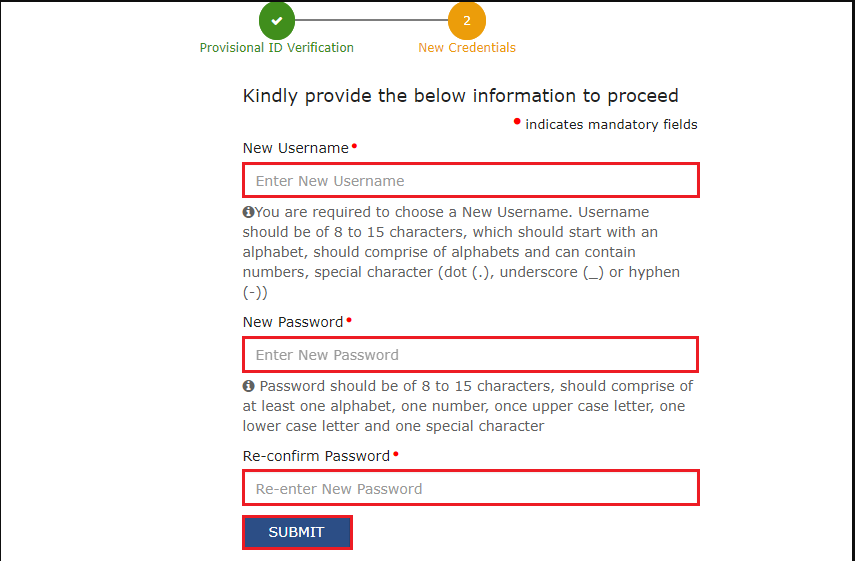

- Next, a New Credentials screen will appear. Enter the New Username that you will use in future to sign in to the GST website.

- Enter New Password followed by Re-confirm Password.

- Click SUBMIT.

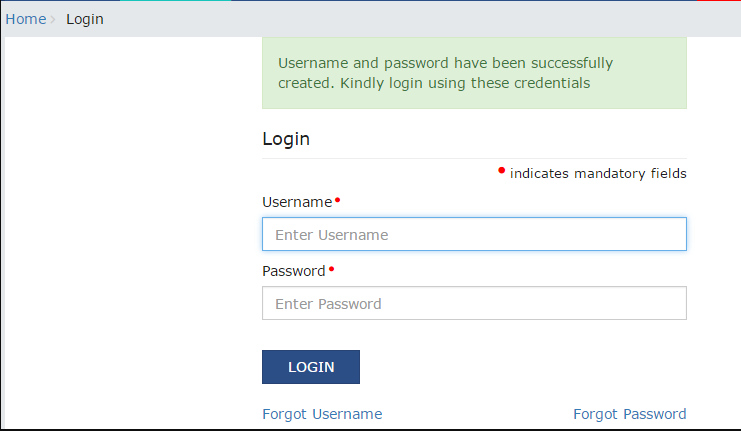

- On successful creation of the new username and password, you will get a confirmation message for the same.

- You are now free to sign in to the GST site by using these details and continue with your GST regime.

- A confirmation message is displayed that Username and Password have been successfully created. You can now sign in to the GST Portal using these credentials.

If you are Migrated taxpayer, you need to provide your Provisional ID and Password when you login to your GST account for the first time.

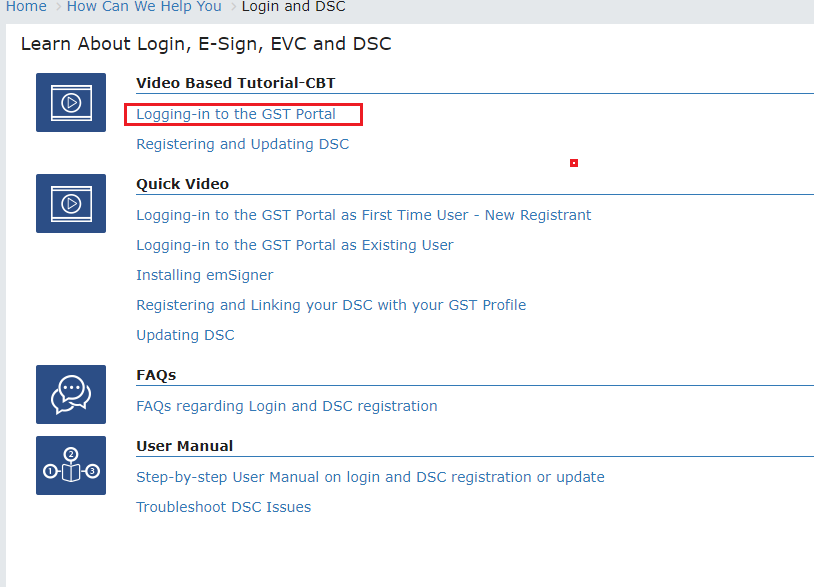

In case you still have doubts on your GST login endeavors, then the GST portal extends cordial support for you. Simply open the link https://www.gst.gov.in and get detailed assistance with the help of videos as well as video tutorials as well as User Manuals. Here are simple steps on the same:

- On the home page, Click Registration.

- In the resulting page, click the block with heading Login, E-Sign, EVC and DSC

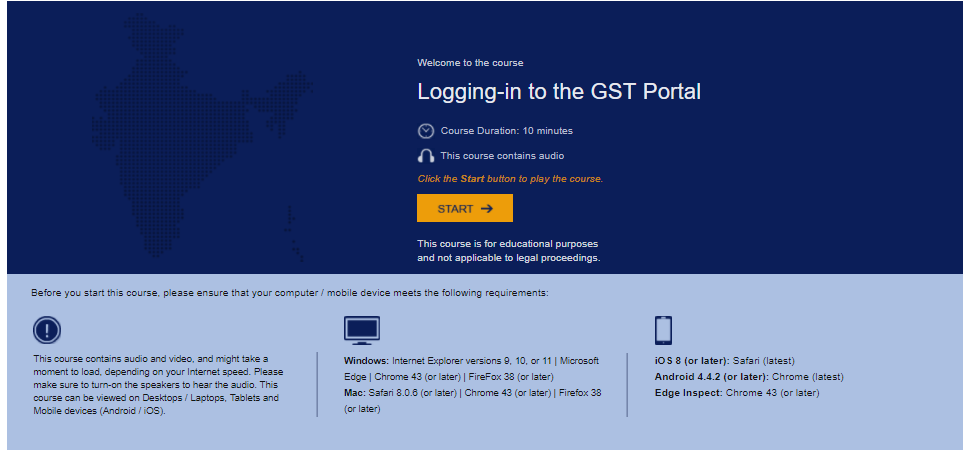

- Click Logging-in to the GST Portal.

- Click Start to go through the video on Logging-in to the GST portal

In, addition, you can also view quick videos on:

- Logging-in to the GST Portal as First Time User - New Registrant

- Logging-in to the GST Portal as Existing User

- You can go through Step-by-step User Manual on login and DSC registration or update

- To avoid any sort of confusion regarding GST login, you can also refer to GST FAQs by clicking this link - FAQs regarding Login and DSC registration

While the GST website is helpful in your effort login with your GST credentials, GInvoicing is also ever ready to assist any of your obligations related to GST. So make sure to contact us whenever you are stuck-up with any of the GST related issues. We will be more than happy to help you out!