Processed data tractions

Since July 2017, India has been set on GST mode, which enables the taxpayers to pay a single tax instead of multiple indirect taxes. This new indirect tax regime, termed as Goods and Services Tax, has been seen a much awaited reform since independence, which subsumes around a dozen of taxed levied by the central and the state governments. As for taxpayers, this tax is expected to affect their daily life positively in the long run. For instance, it leads to significant reduction in the variety of taxes for businesses, as they have to pay lesser rates and exemptions through a comparably simpler tax regime... Read More

Besides your core competency that works acts as a catalyst in your business growth, we at GInvoicing management are dedicated to help you with you GST related hassles. Considering the intricacies involved in abiding by the GST rules, we assist you with a ready to use GST software that emancipates you with all the involved hassles of GST return filings. With GST transforming the Indian tax regime to the digital front, the need to be technology savvy has become evident.

However, even if you possess limited digital awareness, we are there to take up the cudgels in our hand and simplify your task of filing GST returns with ease through our GST ready software... Read More

If you are already fed up of filing GST returns on your own and looking for credible assistance to help you out in the accounting and related efforts, the GST-Ready Software is meant exactly for you. It is all engrossed with advanced and utilitarian features that ultimately aim at reducing your paper work significantly. It automated the workflow of your business and lets you keep track of your multiple warehouses collectively. It offers varied GST featured invoices in India, related to sales, purchases, credit notes, debit notes, payment recording, and online payments... Read More

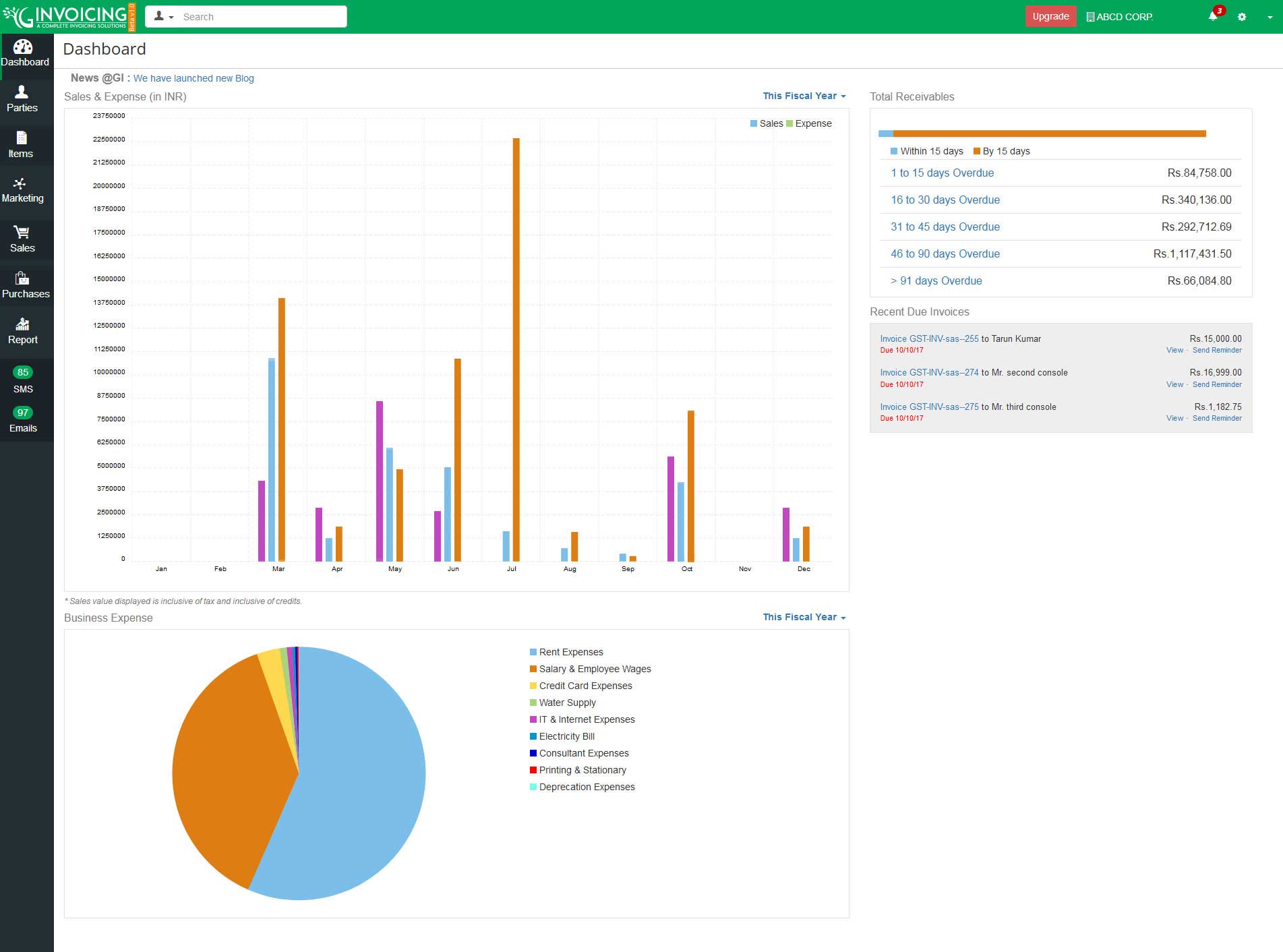

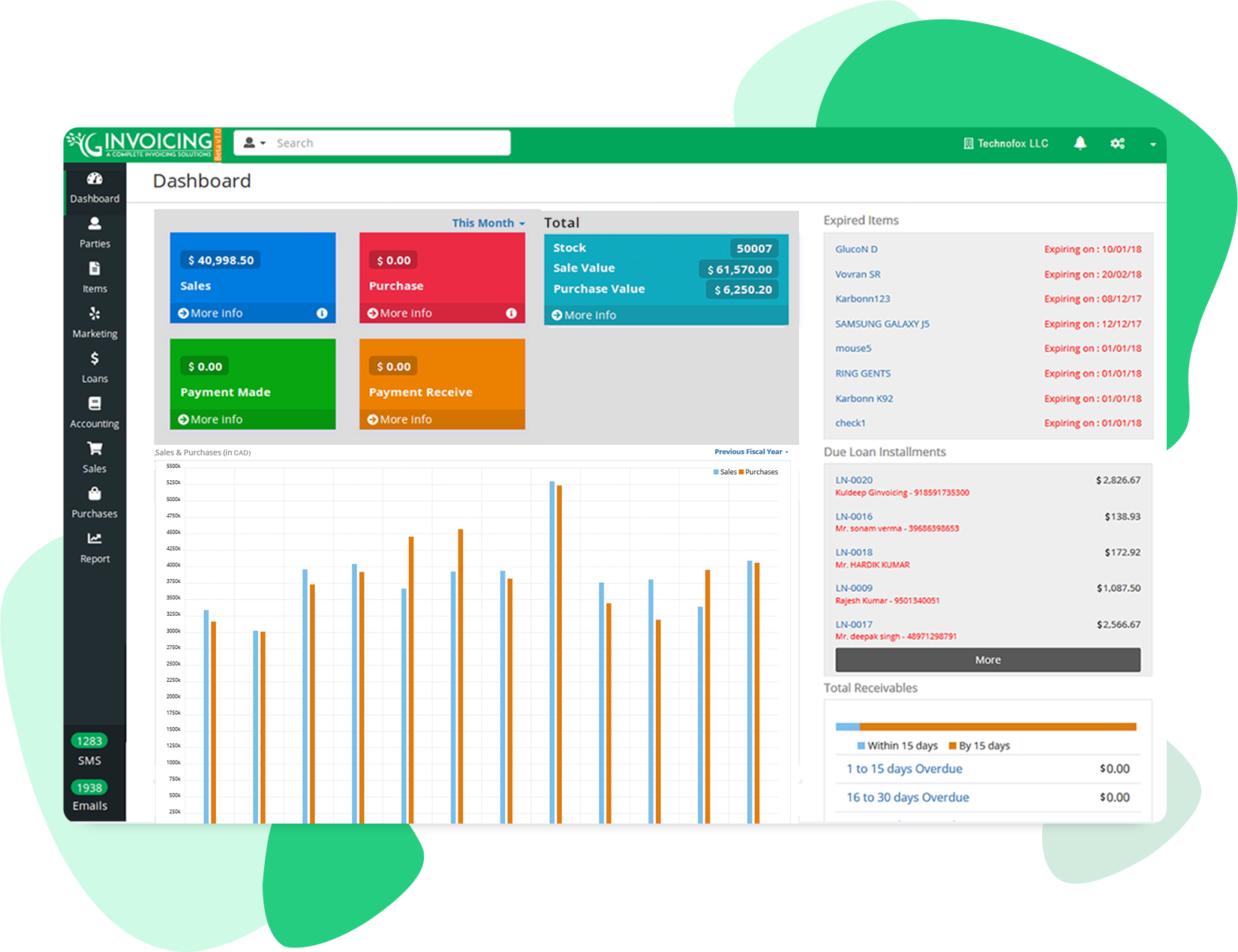

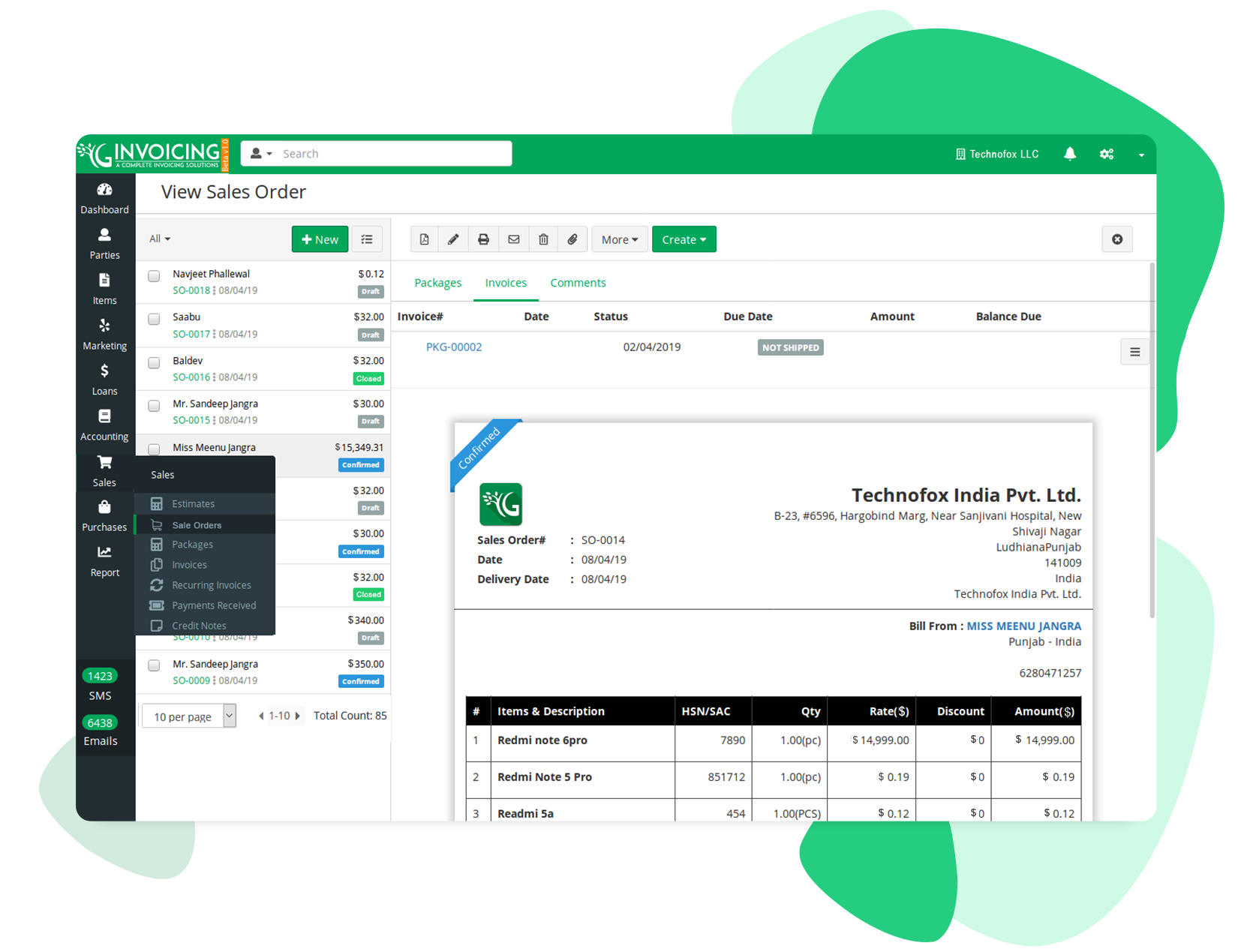

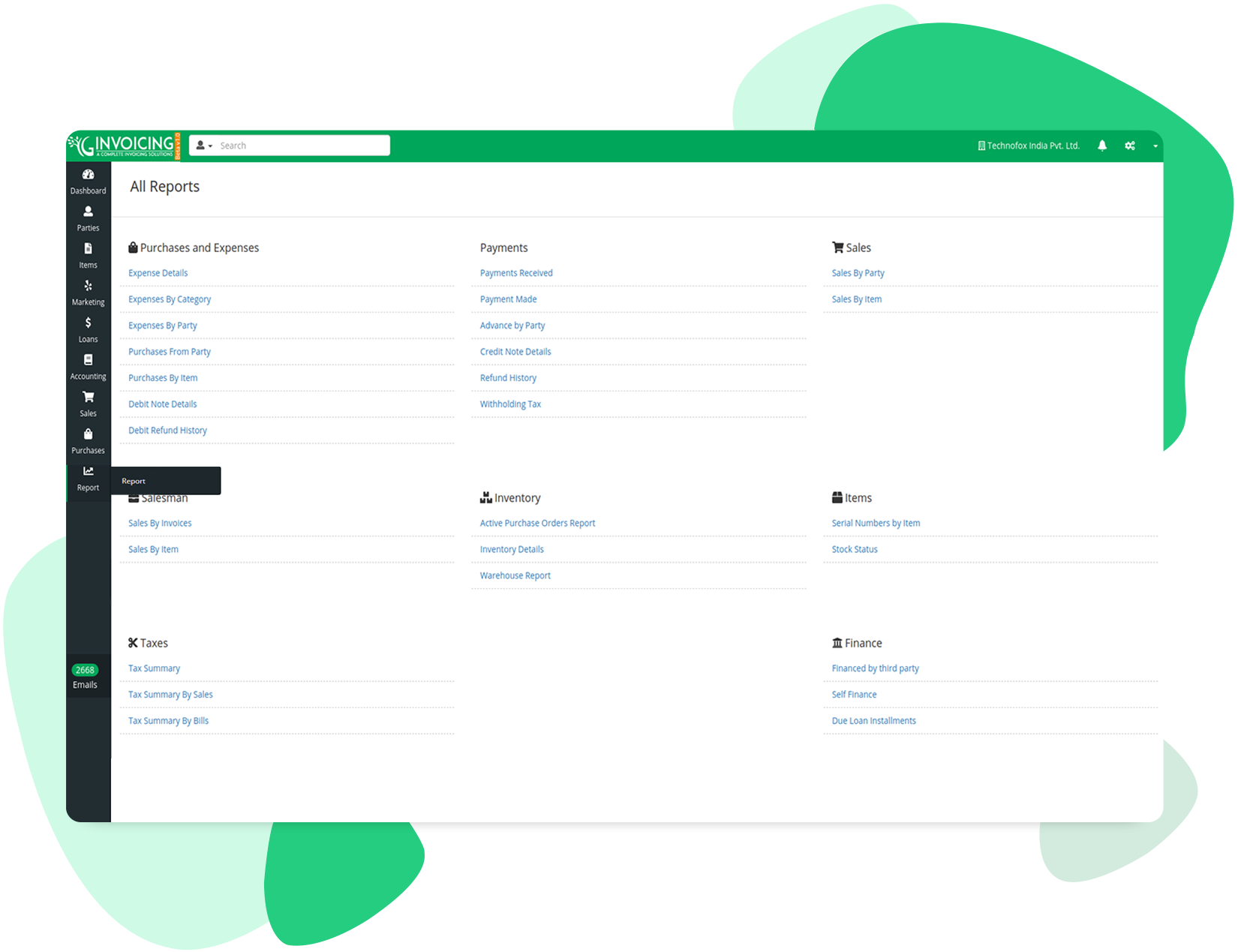

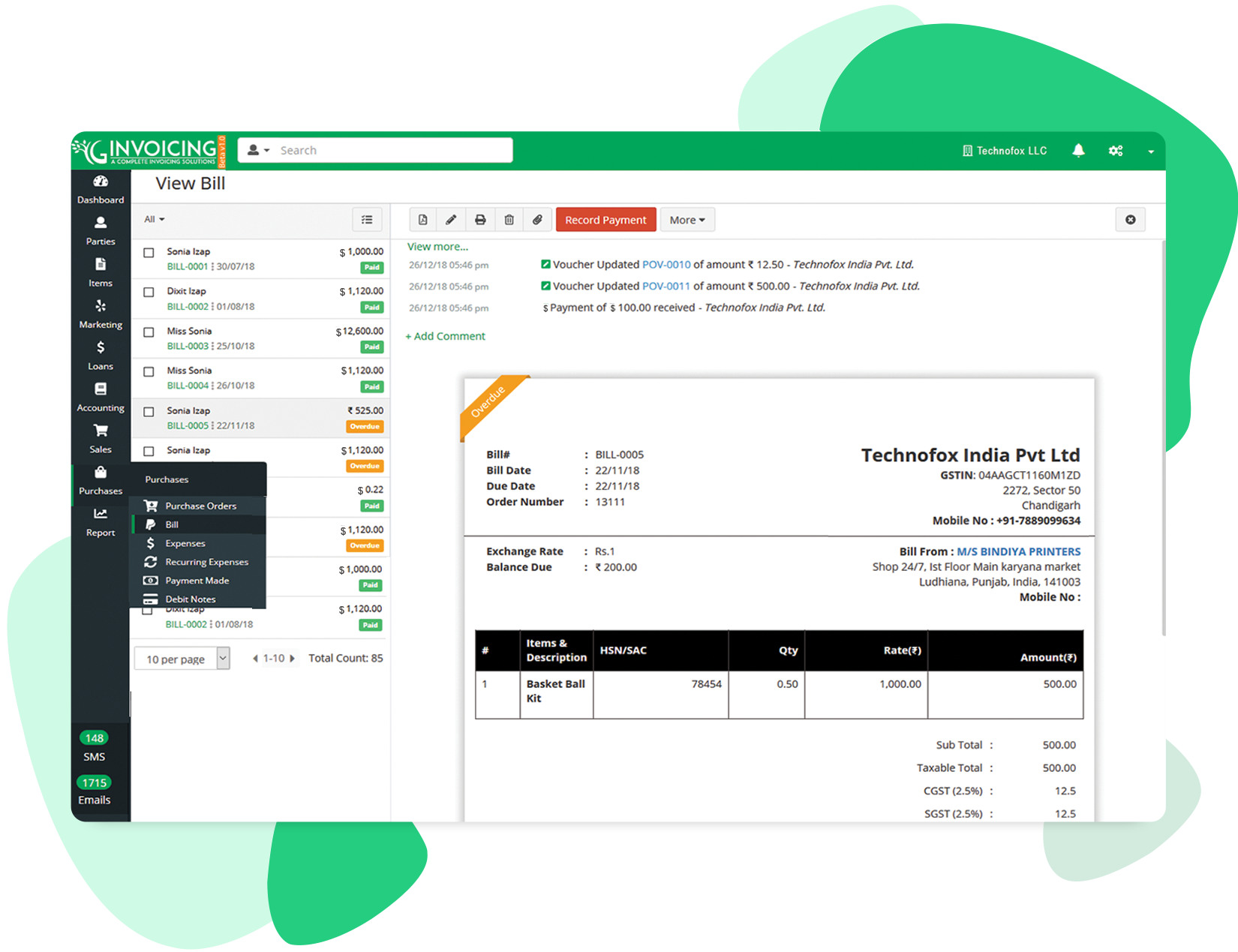

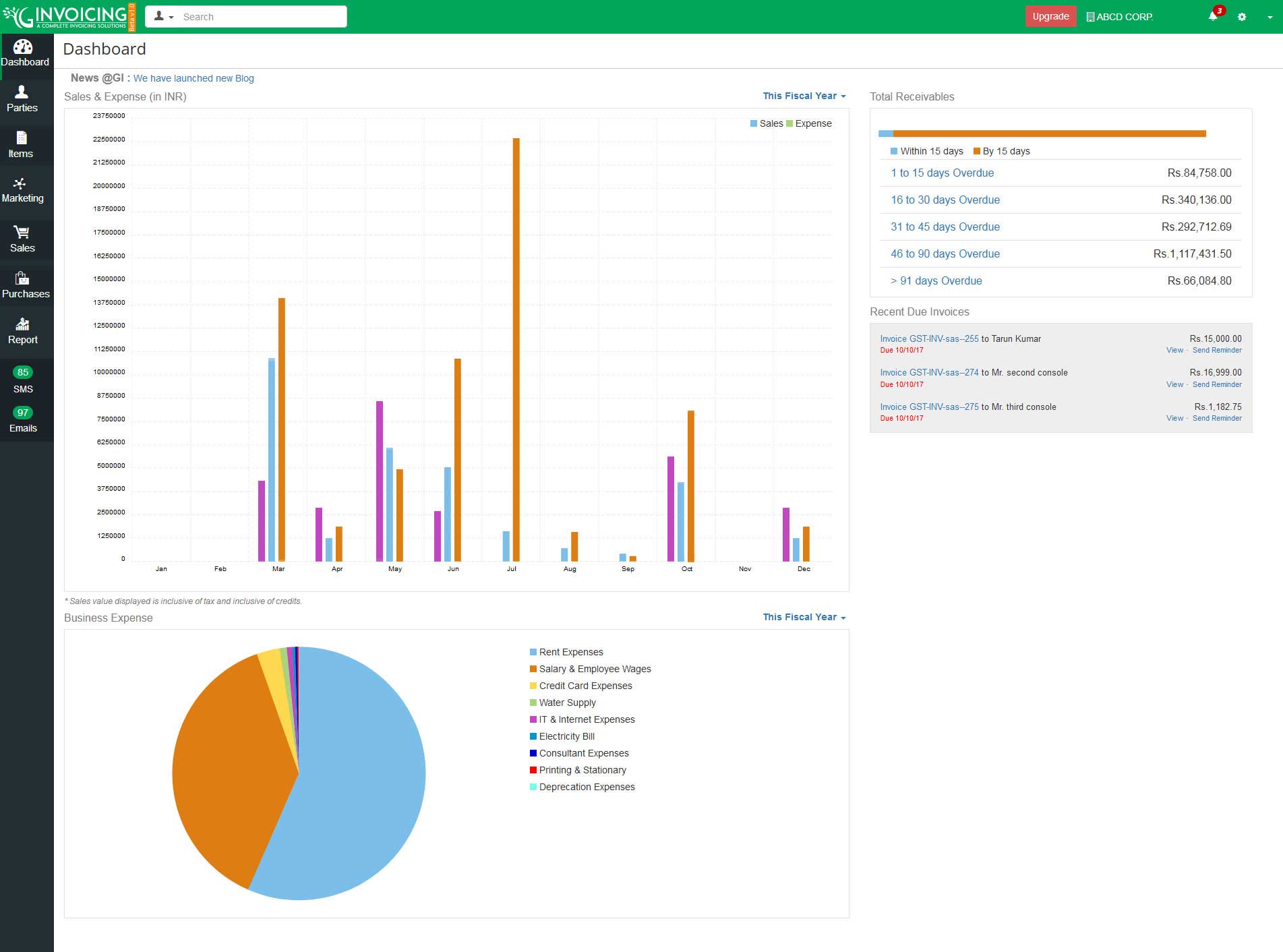

GInvoicing Preview

Dashboard

Parties - List of All Clients, Client Overview, Transactions, Recent Activities, Statements, Contact Details

Items - Itemize, Price List, Adjustment, Transfer Order

Marketing - Bulk SMS or E-mail Marketing to promote your businesses

Sales - Estimates, Invoices, Recurring Invoices, Payment Received, Credit Notes

Purchase - Purchase Orders, Bill, Expenses, Recurring Expenses, Payment Made, Debit Note

Reports - Purchases and Expenses, Payments Received, Sales, Salesman, Inventory, Taxes, GST

Reports - Purchases and Expenses, Payments Received, Sales, Salesman, Inventory, Taxes, GST

Reports - Purchases and Expenses, Payments Received, Sales, Salesman, Inventory, Taxes, GST