GST Online Registration Process

GST or Goods and Services Tax finally transformed to reality in 2017, thereby ending a 17 year long hiatus. After going through various phases under successive governments, the GST Bill was finally approved in the parliament on 29th March 2017, followed by its implementation on 1st July 2017. Also termed as the ‘one nation, one tax’ system, GST brought the nation of 1.3 billion,one step closer toward integrating the $2-trilllion economy into a unified market. However, to make GST a real success on the ground, it requires honest participation from all the citizens of India. It makes time, but altogether, GST is all poised to change the economic status of the nation forever.

To be precise, for businesses whose turnover exceeds 20 lakhs in a year, GST registration has been made mandatory. The threshold limit to apply for GST for North Eastern and Hill States has been set as Rs 10 lakhs. If you also fall under this GST category,you would require doing GST registration online before the deadline ends. But isn’t it good to know the need for GST before we proceed for GST registration for an existing or new business.

WHY GST?

The rolling out of GST has been a watershed moment for India. Prior to the introduction of GST, the indirect tax regime in India was quite complex where the tax payers had to comply with large number of taxes levied by both the central as well as state governments. These pre GST taxes included Central Excise duty, Value Added Tax (VAT), Entry Tax, Purchase Tax, Service Tax, Central Sales Tax, Octroi, Local Body Taxes, Luxury Tax and so on. All these tax forms were not even interconnected, hence leaving ample scope for tax evasion. Thankfully, GST answers all such flaws.

Goods and Services Tax or GST hence simplified the pre-existing tax regime. It levies uniform tax rates across states for all types of inter-state and intra-state transactions, which will in turn endorse compliance and ease of doing business. GST will also reduce the scope for corruption and tax evasion due to following reasons:

- GST, or the ‘one indirect tax for the whole nation’ will reduce net tax liability of the taxpayers and makes them eligible to take tax credit on the inputs throughout India. In fact, GST has already increased the number of tax payers in India appreciably since the news of GST implementation broke out.

- From GST registration to filling GST returns, to getting all the orders, refunds, etc, everything shall be done online, which will further minimize the interface between the officers and the taxpayers.

- The GST promotes a dual monitoring structure which involves Center and the State government, which is yet another step towards the prevention of corruption and evasions.

- Other important factors related to GST, like electronic cross matching of transactions, invoice-wise declaration of sales and purchases, easy tax compliance, Dual control, comprehensive IT structure by GST Identification Number (GSTIN), and more will also contribute toward shutting the door for generating black money.

Online GST Registration

Now let’s know in detail about the process to register for GST, which is quite simple. However, you may also seek the assistance of a CA or any company into finance and accounting sector to go ahead with GST application

Documents required for GST registration online

The need for documents to get a new GST number differs according to the nature of your business. Here is a detailed info on the GST process.

GST docs for Sole Proprietorship Firm

- Proprietor’s PAN card and ID proof – like any other firm registration certificate.

- Copy of Cancelled bank statement or cheque.

- Declaration to abide by the provisions of GST

- Copy of Electricity / Landline / Water Bill

- Rent agreement of the premises

- No Objection Certificate from the premises owner

GST docs for Partnership Firm

- The firm’s Personal Account Number (PAN) card with the Deed

- Partnership registration certificate

- Partners ID proof and address proof

GST docs for Private Limited/One Person Company

- Personal Account Number (PAN) card of the Company, MOA, COI & AOA of Company

- Board Resolution with Address and ID proof of the Directors

GST docs for LLP (Limited Liability Partnership)

- Pan Card and COI of the company

- Partners ID and Address Proof + Deed

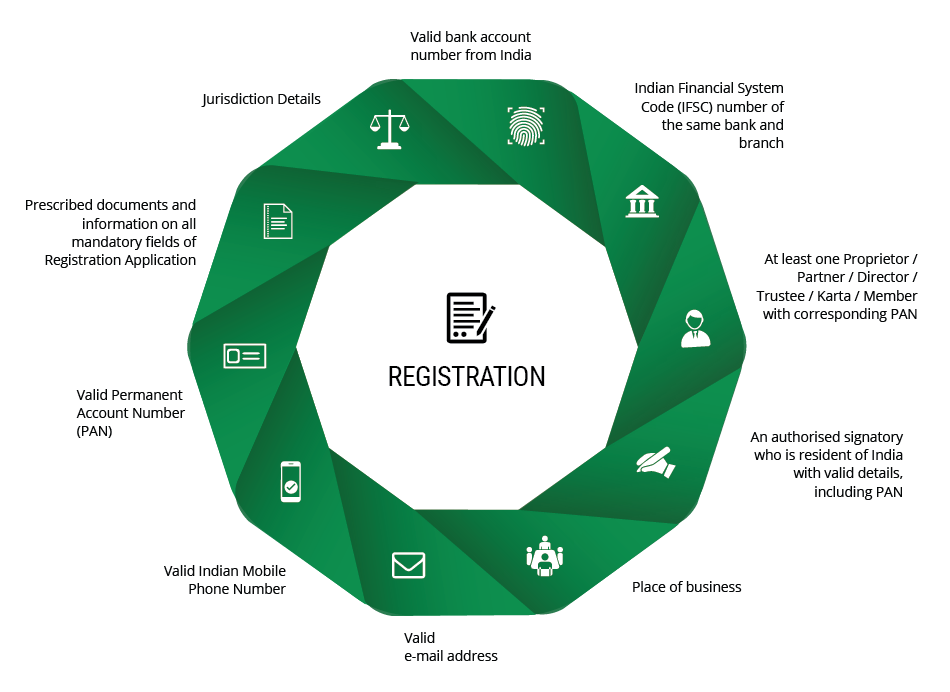

Other important details besides the prescribed documents that you will require to become a registered GST payer include:

- Valid Indian contact number

- Valid email-address

- Valid Indian bank account number

- IFSC code of the same bank and branch

- Place of business

- An Indian resident as an authorized signatory who possesses valid details including PAN

How to register for GST process?

Companies or individuals can apply online to register for GST via GST Online Portal. Alternatively, the GST Seva Kendra set up by the central government also helps businesses and GST taxpayers with GST registration. All the centers of GST Seva Kendras have direct link to the GST Network, Central Board of Excise and Customs portals. They are operated by trained officers hence leaving behind any scope for error or discrepancy for the GST tax payers to get registered.

Here are the steps to help you with online registration through the GST portal:

On the address bar of your browser, type https://www.gst.gov.in/ and press Enter.

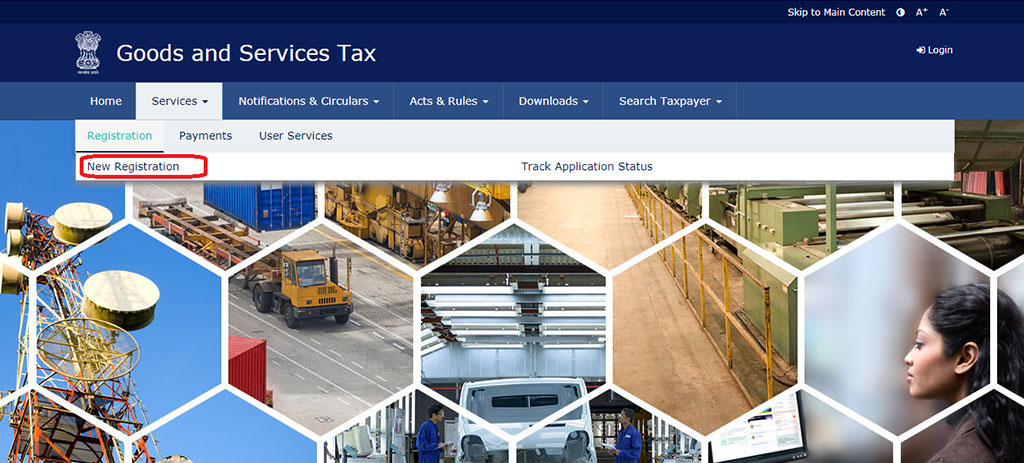

In the main menu, click on Services -> Registration -> New Registration.

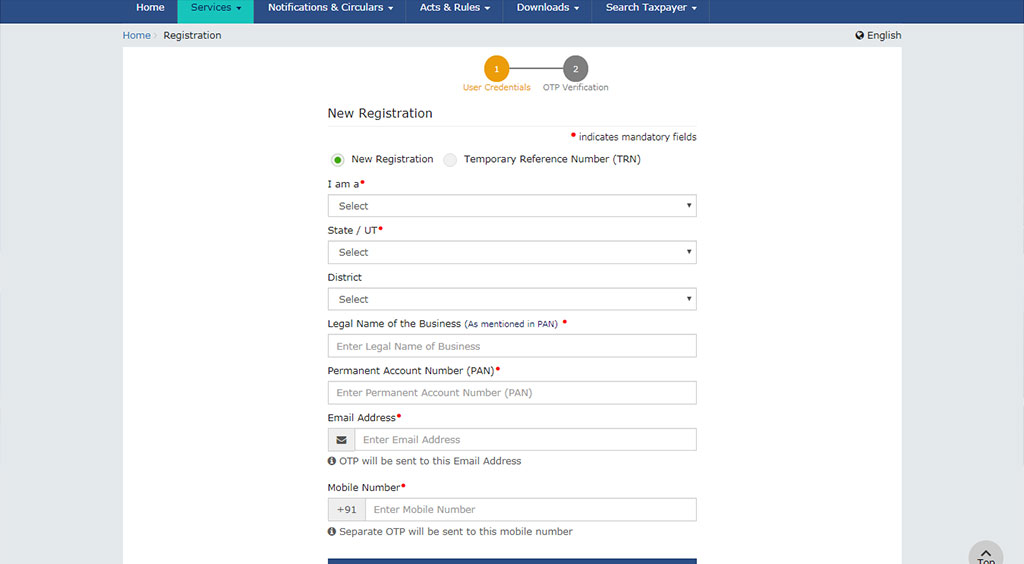

Provide all the requisite details in the form that appear next, such as your PAN, Email Address, Mobile Number, etc. This will be the Part-A of GST REG-01 form.

Click the ‘Proceed’ button to register.

Soon after, you will get a temporary reference number on your phone and through E-mail post OTP verification. Next, you will fill the Part-B of GST REG-01 form duly signed by EVC or DSC, by providing the received number.Upload the documents as per required in the GST form depending on your business type.

You will receive an acknowledgement in the Form GST REG-02.

After going through your application, if the officer finds any shortcoming, the officer may ask for additional documents/details in Form GST REG-03.</p> In any such case, you need to provide documents together with form GST Reg-04. If your GST application still gets rejected, you will be informed about it in the Form REG-05. Finally, you will get a GST certificate of registration from the department after verification and approval in Form GST REG-06. You will also be assigned a unique Goods and Services Tax Identification Number or GSTIN.

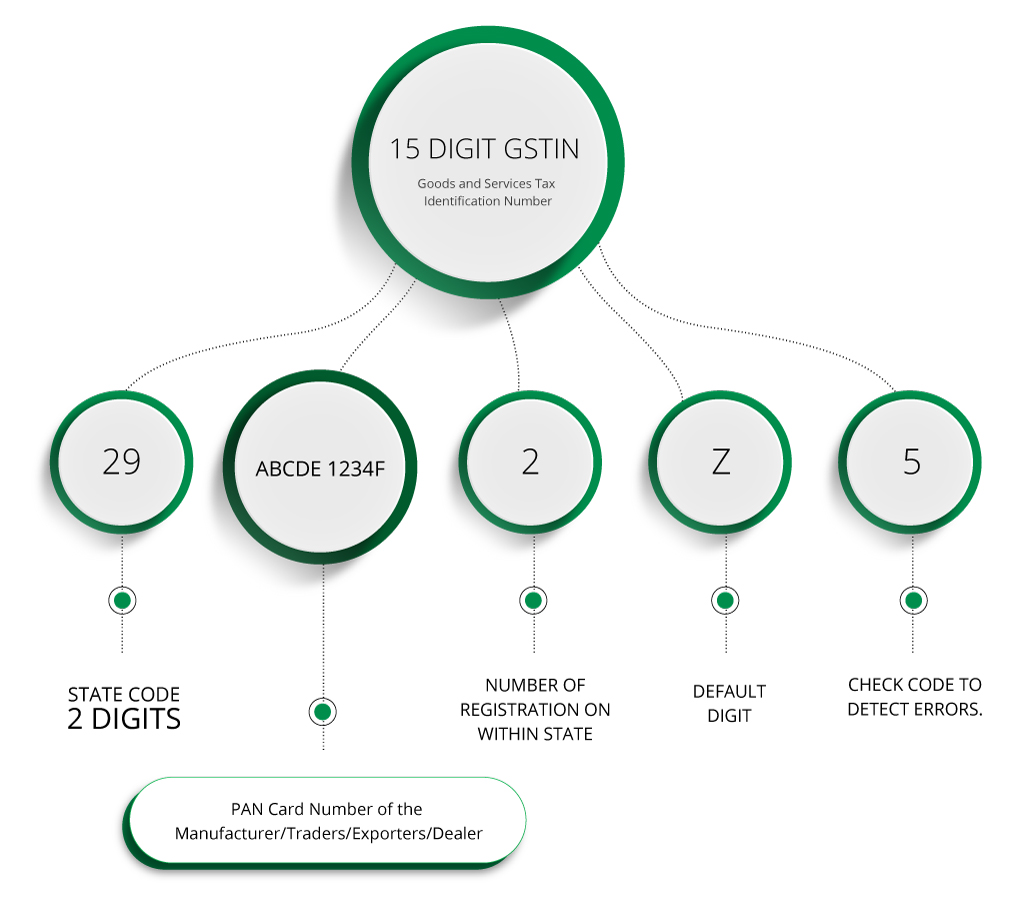

What is GSTIN?

Businesses that successfully register for GST online get a unique number, which is termed as GST Identification Number or GSTIN. The image below gives a clear picture of the structure of GSTIN:

As you can see, the GST ID Number is a mix of different digits and numbers to ensure the security of your account. Once you get your GST number, you are free to abide by GST return.

Cost of GST Online Registration

The government of India allows the business people and companies to get registered under GST, or to apply for migration from existing VAT/CST number to GST number free of cost. However, you need to prepare the Class 2 Digital Signature to sign the GST application form electronically. The digital signature will cost you around 1000/-INR. Alternatively, you can also provide the Aadhar based OTP, which will help you to apply for GST registrations for free. If you hire the services of professional companies to register for GST, you will require to pay as per their expectations.

Benefits of getting registered under GST

Even at present, there are confusions regarding the advantages that GST will ensure to tax payers in the long term. Hence, just to let you know, with GST registration, you have eased out your business appreciably. In fact, as you register with GST - the new ‘one country, one tax’, it will bring all the taxes levied by state and central government under a single umbrella.

Here are some instant benefits:

- One Country, One Tax: GST has simplified the process for tax paying as it combines all the indirect taxes into one single tax.

- Ease of business: Once you get registered under GST process, you don’t require to register for different taxes separately. GST allows you to do trade almost anywhere in India hence making the nation a unified marketplace for startups and established traders. However, here it is important to note that if a business is operating from multiple states, then it would require to apply for separate GST registration for each state. Likewise, if you have different business verticals within a state, it may also require you to obtain different GST registration for every business field.

- Enhanced threshold limit for Startups: The GST registration keeps businesses with annual turnover less than 20 lakh INR (10 lakh for North East states), out of its GST regime. Naturally, this includes the existing small companies as well as startups

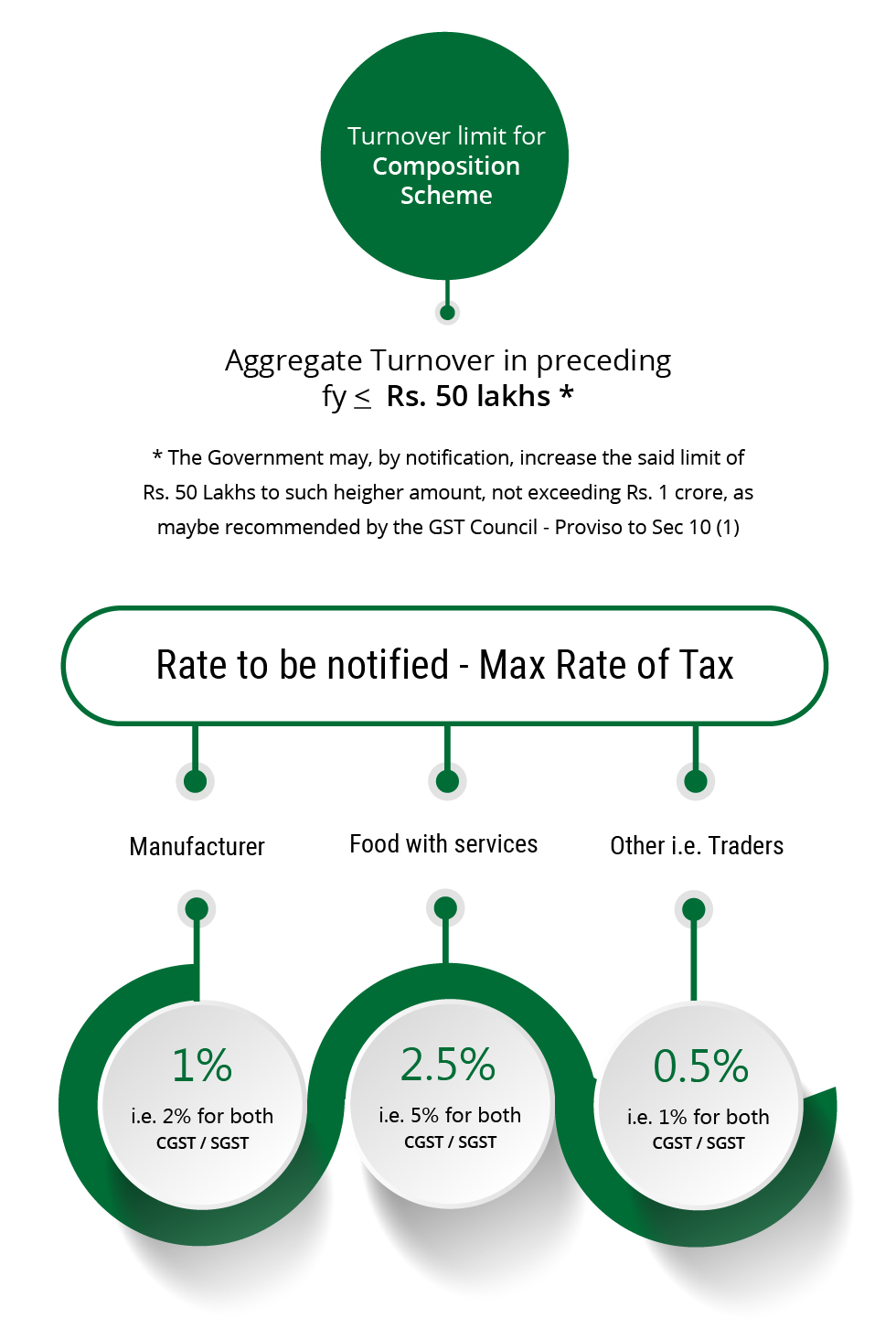

- Composition Scheme: This GST scheme requires the companies and individuals with turnover under Rs 75 lakh to pay nominal tax rates depending on the type of business.

- Reduced Logistic cost: Trader/manufacturers, etc. registered under GST process may well expect reduction in the logistic cost by around 20%. This will help the e-commerce startups to spend lesser amount to establish their business as compared to the pre GST era. This GST benefit will also make way for enhanced business for companies into logistics.

- Slashed compliance cost: The cost for overall compliance will also come down heavily under GST procedure since there is only tax to pay for. It will further ensure transparency and clarity in the calculation of input tax credit and GST taxes.

GST has been introduced to make the life of the traders in India simpler than ever. All you need is to be aware and file for GST before the government calls it a day for new applications. In the initial quarters, GST may seem dreary due to involved intricacies.However, you can get away with them on browsing through the official government portal on GST. Best wishes for your GST regime.

To know more about how to apply for GST registration or other aspects of GST procedure, feel free to contact us at GInvoicing,the ultimate online destination for GST invoicing.